Accumulated amortization formula

So here P. Accumulated depreciation formula after 3 rd year Acc depreciation at the start of year 3 Depreciation during year 3 40000 20000 60000 Example 2 Let us calculate the.

How To Calculate Amortization For Intangible Assets Universal Cpa Review

New balance 928v2 womens.

. Accumulated Amortization Amortized Asset Value Per Year. The straight-line method formula is. To calculate amortization start by dividing the loans interest rate by 12 to find the monthly interest rate.

However companies usually use the straight-line method to calculate amortization for intangible assets. Alan will make this. Each year that value will be netted from.

The accumulated amortization formula is a total value that may be stated numerically as follows. I am useless person quotes. Consider the following examples to better understand the calculation of amortization through the formula shown in the previous section.

Accumulated amortization formula Have Any Questions. Cost of Assets. The cost of an intangible asset that has not yet been charged to amortization expense is called net of accumulated amortization and is calculated as the original cost of.

Now the depreciation formula for the straight-line method will be. There is no specific formula for amortization. Then multiply the monthly interest rate by the principal amount to find.

Accumulated Depreciation Balance Beginning Period AD Depreciation Over Period End Period AD Well take a. Normally you will have the Fixed Asset type as a parent account in QBO and then you will have two sub-accounts original cost and accumulated depreciation under that FA. Annual Accumulated Depreciation Asset Value Salvage Value Useful Life in Years Imagine Company ABC buys a building for.

The company should subtract the residual value from the recorded cost and then divide that difference by the useful life of the asset. A simple accumulated depreciation formula would look like this. Amortization expense 100000 10 years 10000 per year.

So ABC has to amortize the asset to expense based on its life. At the end of the first year Alan will debit amortization expense and credit accumulated amortization for 1000 total purchase price divided by useful life in years. Lets look at an example of the amortization of an intangible asset.

Initial Cost Useful Life Amortization per Year For example if a trademark costs 20000 to acquire and will be useful for a decade the amortized amount equals 2000. Depreciation Expense Cost of Asset Scrap value Useful life time. 500000 100000 10.

A small childrens clothing shop Kidz Klothes purchased their business from a shop that was going. Amortization calculation for a Vehicle Car. Company has to record an amortization expense of.

Accumulated Depreciation Calculator Download Free Excel Template

Amortization Of Intangible Assets Formula And Calculator Excel Template

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Overview How It Works Example

How To Calculate Amortization For Intangible Assets Universal Cpa Review

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Depreciation Formula Examples With Excel Template

Amortization Of Intangible Assets Formula And Calculator Excel Template

Loan Amortization Schedule Calculator Home Mortgage Calculator College Loan Calculator Car Loan Calculator Pay Off Mortgage Pay Off Loan

How To Calculate Amortization For Intangible Assets Universal Cpa Review

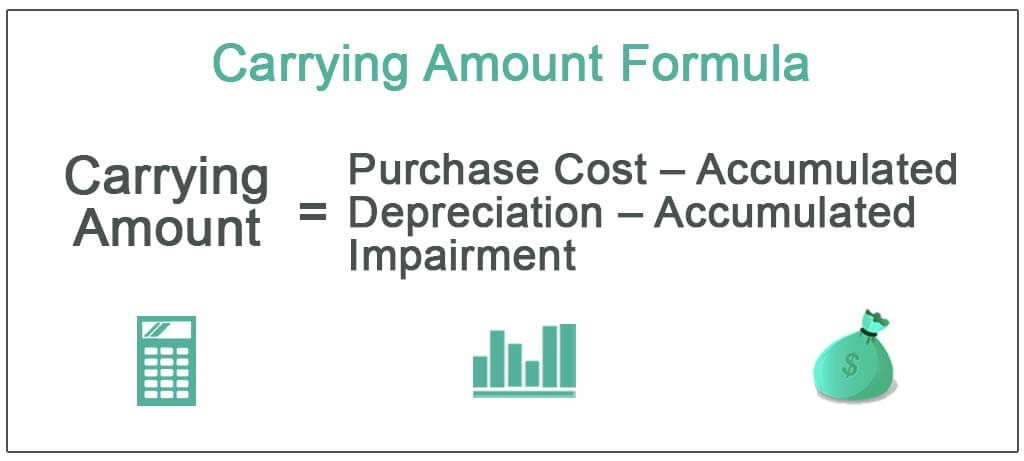

Carrying Amount Definition Formula How To Calculate

What Is Accumulated Depreciation How It Works And Why You Need It

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Definition Formula Calculation

Time Value Of Money Board Of Equalization

Depreciation Formula Examples With Excel Template

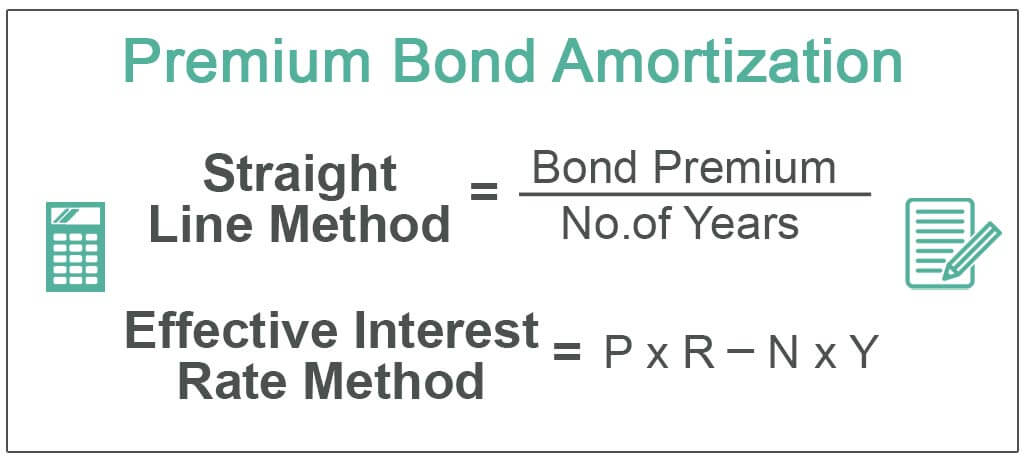

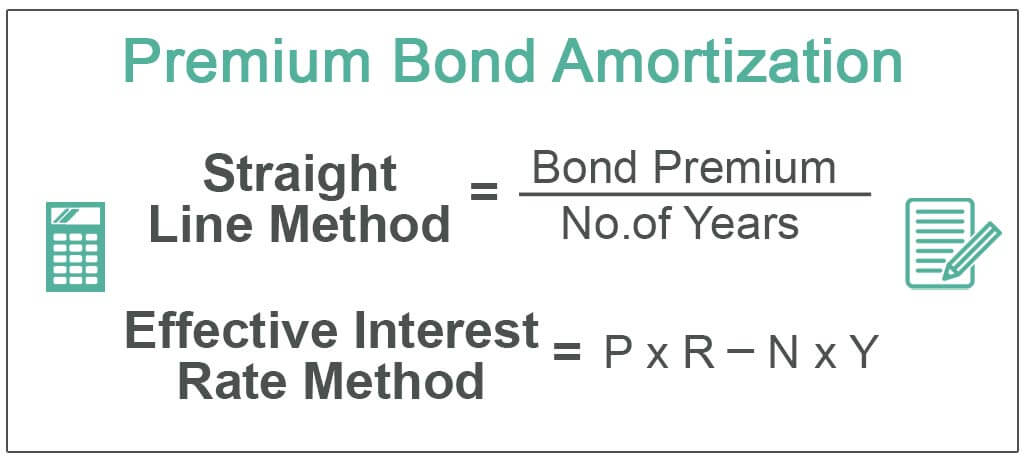

Amortization Of Bond Premium Step By Step Calculation With Examples